By Maria Pemberton

Boston University News Service

Massachusetts residents will have a crucial voting issue on their plate this November: Should full-service restaurants and bars increase their minimum wage for tipped workers?

The current state law mandates that restaurants pay their workers a minimum of $6.75 per hour as long as their total earnings, when combined with tips, is at least $15 per hour. This $8.25 difference is known as the “tip credit.” When tips can’t make up this difference, restaurants are required to pay the full $15.

Question 5 on the Massachusetts ballot would gradually eliminate this system of tipped wages. In increments over the next five years, restaurants will be responsible to pay the $15 regardless of the worker’s tips. This legislation would also permit “tip pooling” between front and back of the restaurant employees.

The organization One Fair Wage is spearheading the movement to vote “YES” and abolish the tipped minimum wage in Massachusetts and beyond. Similar legislation removing the tipped minimum wage has passed in seven states.

Grace McGovern, a Massachusetts worker organizer for One Fair Wage said transparency, fairness and increased wages for workers are all possible benefits from this legislation.

“It’s fair to consumers who aren’t always aware that they’re subsidizing an employer’s labor costs, and it’s also fair to the over 100 restaurants in Massachusetts that already pay one fair wage,” McGovern said.

According to Tufts University Center for State Policy Analysis, full-service restaurant workers in states without tipped wages bring home higher earnings.

“The biggest impact of increasing the subminimum wage is putting a little bit more money into the pockets of those who desperately need it,” McGovern said.

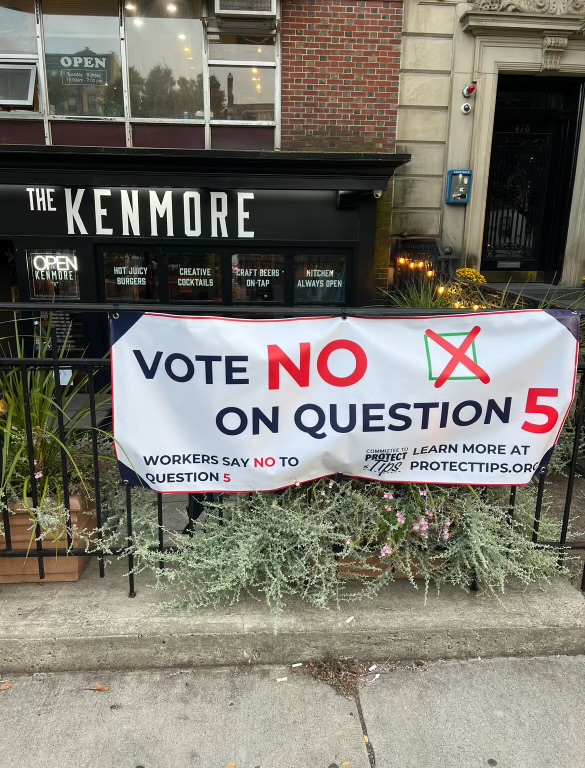

On the opposition, the Committee to Protect Tips is advocating for residents to vote “NO” because of its potential increase in prices for customers, fewer shifts for workers and possible restaurant closures for business owners.

Chris Keohan, spokesperson for the Committee to Protect Tips, says restaurant owners may need to use alternative service methods and technology instead of waiters on the floor to offset labor costs.

“They [consumers] would see more automation, more moves from full service to table service type restaurants,” said Keohan. “And unfortunately, as evidenced by Washington, D.C., which is one of the most recent to implement this, you’ll see a significant amount of closures of restaurants that just can’t possibly make that work.”

Economic professors for the Southern Economics Journal have found removing the tipped credit, while increasing wages, reduces employment in full-service restaurants.

With the proposed system, mandatory service charges controlled and distributed by the restaurant managers, said Keohan, may serve as the alternative to tips that go straight to the pockets of servers.

Doug Bacon, the owner of eight Boston restaurants and former server, said he likes the current system because it rewards hustling servers and reduces labor costs for businesses.

“Consumers understand that servers and bartenders make a lower wage from the restaurant, and the tips more than make up the difference,” Bacon said. “That’s an incentive for people to give great, friendly, efficient service and hospitality.”

Bacon went on to say local affordable restaurants are the ones that would most be affected by this change because of the “dramatic change in operating expenses.” He describes these restaurants as the “lifeblood” of Massachusetts, and the restaurant industry could be “hollowed out” because of this change.

Sam Seminatore, Massachusetts resident and former waiter, said that the current service system rewards workers that perform to the best of their ability. He says tip pooling is unfair to workers that try to stand out in their job.

“The restaurant industry makes sense to be commission based for servers because it’s about how good you are at your job, how many people you serve and what kind of service you provide,” Seminatore said.

Question 5 will be voted on by residents on Election Day, Nov. 5. If it passes, tipped minimum wages are expected to be completely phased out by Jan. 1, 2029.